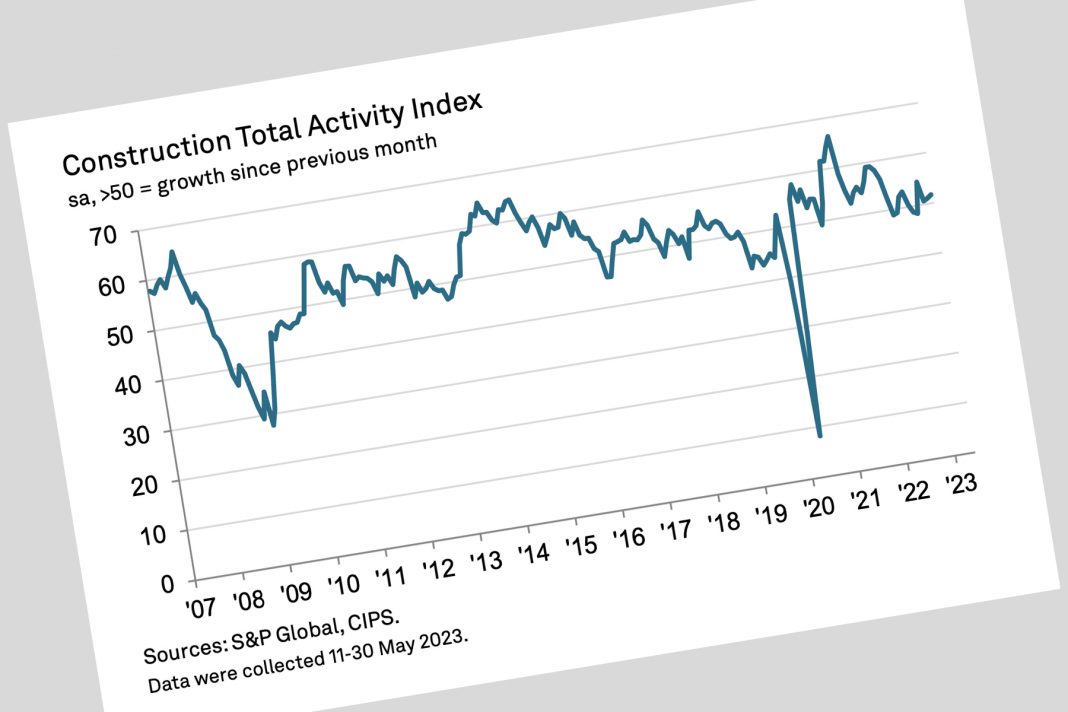

Mixed fortunes are highlighted in the latest S&P Global construction survey, with house building in deep decline while commercial grows, against a background that sees earlier serious supply problems continuing to normalise.

Improving supply issues, highlighted by the greatest improvement in vendor lead times since August 2009, helped to alleviate cost pressures across the construction sector, with the overall rate of input price inflation easing to its weakest for 32 months.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “May data highlighted a mixed picture across the UK construction sector as solid growth rates in commercial and civil engineering activity contrasted with a steeper downturn in house building. Rising demand among corporate clients and contract awards on infrastructure projects meanwhile underpinned the fastest rise in new orders since April 2022.

“However, cutbacks to new residential building projects in response to rising interest rates and subdued housing market conditions resulted in the sharpest drop in housing activity for three years. This meant that residential work underperformed the rest of the construction sector by the greatest margin since October 2008. Survey respondents also commented on concerns about the broader UK economic outlook, which contributed to an overall drop in output growth projections to the lowest for four months.

“Inflationary pressures meanwhile eased considerably May, with purchase prices increasing to the smallest extent since September 2020. Supply chain normalisation helped to moderate cost inflation, as signalled by the strongest improvement in delivery times for construction products and materials for almost 14 years.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), said: “Though overall output in the construction sector showed an improvement for the fourth month in a row, the steepest drop in house building activity since April 2009, barring the initial pandemic lockdown in early 2020, will send a chill down the spine of the UK economy.

“The residential sub-sector is closely linked to consumer confidence and levels of spending. A further hike in interest rates is expected this month, and along with the relentless increase in the cost of living is making buyers hesitate about purchasing homes. As a result, builder confidence was pinched to remain below the survey average, as business costs remained high and firms expanded their workforce numbers at only a modest pace as they were cautious about their own affordability rates.

“Even with the strongest increase in new orders for just over a year, where commercial and civil engineering projects made up the shortfall, purchasing activity remained flat. Companies were de-stocking their built-up supplies because, with the fastest turnaround in supplier delivery times since August 2009, builders expected that demands for materials would be met should a longawaited sustainable upturn ever arrive.”

www.spglobal.com