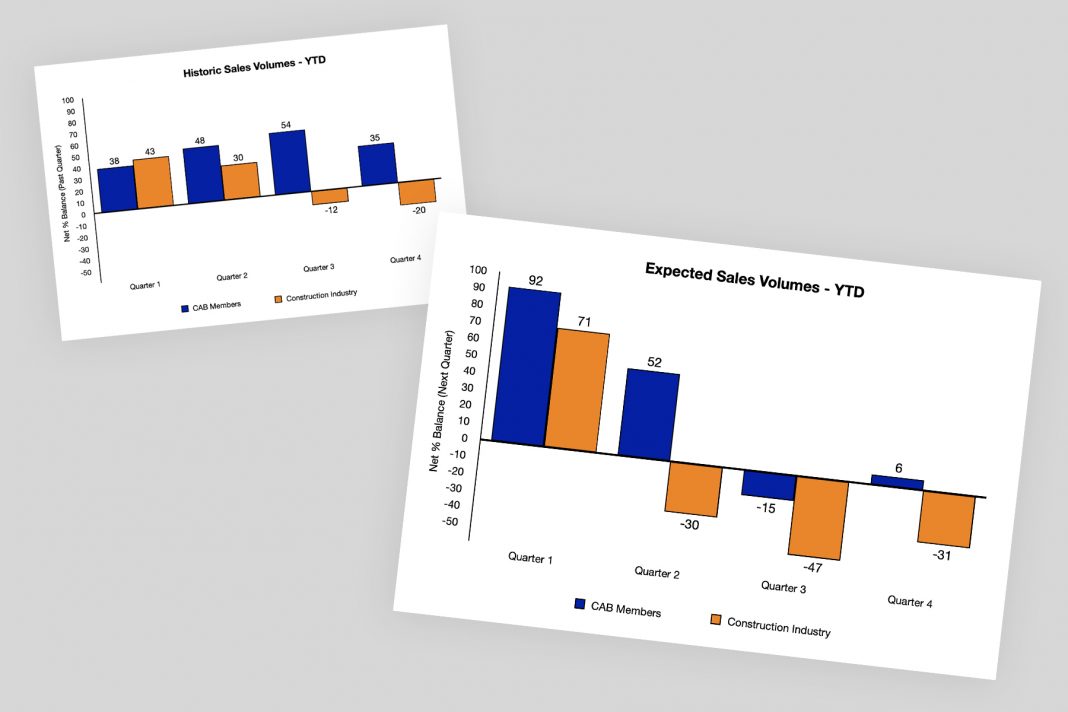

Hints of cautious optimism for the aluminium sector are seen in the latest CAB State of Trade Survey, with a net increase in sales for the first three quarters of 2022 in the face of declining output across construction as a whole.

“Reviewing CAB’s State of Trade Survey produced alongside other construction products output by the Construction Products Association there may be a glimmer of light ahead,” said CAB CEO Phil Slinger.

“Most CAB Members have reported positive ‘Sales Volumes’ during 2022 with some reduction in volumes. In Q4 almost all CAB Members are optimistic for the ‘Sales Volumes’ for the year ahead.

“Whilst pressure on ‘Unit Costs’ started the year at 100% on net balance of all respondents, this has softened during 2022 with a further fall in Q4.

“As expected, the pressure on ‘Cost Factors’ remains high with the pressure off raw material costs but with energy costs causing the greatest concern followed closely by fuel and wages & salary pressures.

“Demand for product continues to dominate the ‘Likely Constraints on Activity Over the Next 12 Months’ for CAB Members. In Q4 this constraint is closely followed by the availability of material supply.

“In Q4 27% of CAB Members on net balance are operating at over 90% capacity, when reviewing ‘Historic Capacity Utilisation’. This remains fairly constant throughout 2022. CAB Members see this increasing to 38% in 2023.

“For CAB Members ‘Labour Force’ and ‘Labour Costs’ have remained positive on net balance confirming that these is a shortage of experienced and qualified labour. The 94% on net balance 2023 outlook suggests that this is a of growing concern.

“Approximately half of CAB Member respondents continue to export product, most only up to 5% of their turnover. Sales exports during 2022 have increased incrementally which is likely due to preferential exchange rates for overseas buyers.”

He concluded: “Despite uncertain times during 2022 CAB Members and the wider construction products sector continue to invest most of their ‘Capital Investment’ in renewing plant & equipment and product improvement. As the Construction Industry continues to move towards a zero carbon emission future plant and product changes are needed to keep up with competition and legislation changes. This will continue to evolve in the coming years as legislation continues to force innovation.”