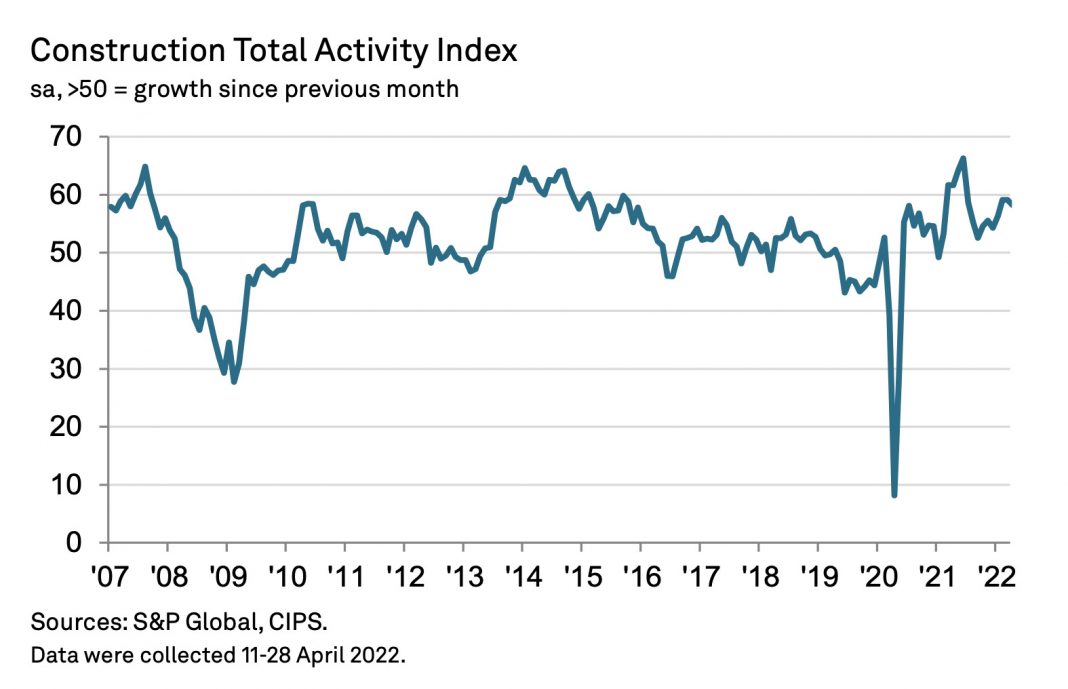

UK construction companies reported another strong rise in business activity during April, but the speed of recovery lost momentum amid weaker new order gains, according to the latest CIPS Construction PMI report from S&P Global.

Tim Moore, economics director at S&P Global said: “The construction sector is moving towards a more subdued recovery phase as sharply rising energy and raw material costs hit client budgets. House building saw the greatest loss of momentum in April, with the latest expansion in activity the weakest since September 2021.Commercial and civil engineering work were the most resilient segments, supported by COVID-19 recovery spending and major infrastructure projects respectively.

“Construction companies have built up strong order books since the reopening of the UK economy, which led to another round of rising employment in April and these project starts should keep the sector in expansion mode during the remainder of the second quarter.

“However, tender opportunities were less plentiful in April as rising inflation and higher borrowing costs started to bite. Consequently, longer-term growth projections have slumped from January’s peak, with business optimism now the weakest since September 2020.”

Duncan Brock, group director at the Chartered Institute of Procurement & Supply, said: “A slowdown in output growth amongst builders in the UK has highlighted a number of issues to be concerned about including rising costs, shortages and a hesitancy amongst customers. “New order levels rose at the slowest pace since the end of last year. There were fears around disrupted supplies as 45% of supply chain managers reported longer lead times. To counteract some of these challenges and with an eye on the future, supply chain managers were building stocks resulting in another sharp rise in purchasing activity. “Inflation hit the highest rate since September 2021, impacted on budgets and made customers think twice about committing. Job creation grew quickly to complete work in hand, risking over-inflating capacity should new order growth slow further. With the Bank of England confirming the interest rate as the highest for 13 years, the squeeze on business lending also led to a relatively gloomy outlook amongst builders for the year ahead, with sentiment the lowest since September 2020.”