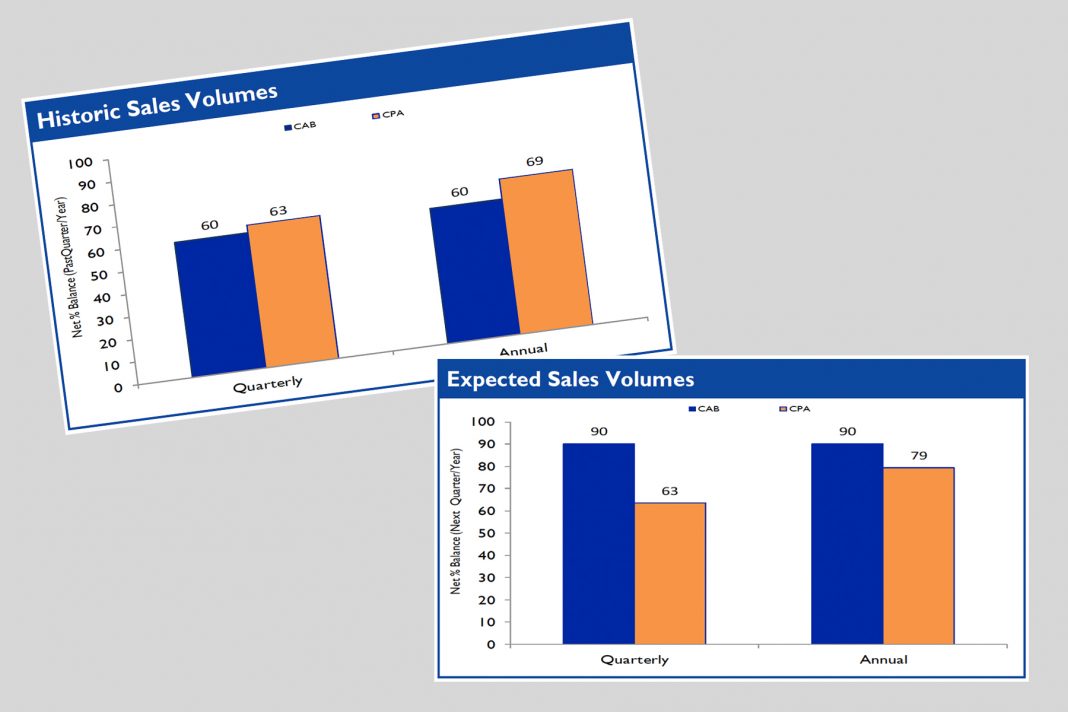

Over two thirds of members of the Council for Aluminium in Building saw sales increase by over 5% in the last 18 months, with a record 90% expecting sales to increase in the next quarter, according to latest figures from the organisation.

However, 80% says they have seen costs increase, with 90% bracing themselves for further hikes in the near future, and 90% see raw material costs as the most influential.

Whilst 42% of members see the availability of materials as the major constraint on activity, 32% of members also cite demand as a likely future constraint, says the organisation. This suggests that possibly not all sectors are seeing a steady growth.

With historic capacity utilisation of 45% of members operating at over 90% capacity over the last quarter, this is a significant increase from the 30% of members operating at over 90% capacity over the last year. The wider construction industry lags slightly behind at 36% and 26% respectively.

Members are cautiously optimistic about further growth, with just 47% of members forecasting that their capacity utilisation will continue to be over 90% in the next quarter. However, 50% of members see a capacity utilisation of over 90% for the year ahead. With a similar forecast increase in capacity utilisation in both the membership and the wider industry, this shows a stable optimism for the year ahead.

Some 53% on net balance of members are seeking to increase their labour force in the year ahead and 13% claimed that they had increased their workforce in the last year. These figures again closely follow the wider construction industry forecasts.

42% of members have seen increases in labour costs in the last year, with 74% on balance forecasting increases in labour costs in the year ahead. Again, these figures closely follow the wider construction industry.

As a proportion of sales, 55% of members reported that none of their production is exported which matches that of the wider construction industry in the UK. Only 5% of members claimed to be exporting more than 15% of their production. The wider construction industry saw a drop of exports in the last year of 8% on net balance likely to be due to the remnants of Brexit.

As would be expected, capital investment is aimed at plant and equipment with 74% of members on net balance stating that investment had been made in the past year with a further 63% on balance stating the future investment would be made in plant and equipment.

42% of members on net balance confirmed that product improvements in the last year and the year ahead are a second priority for capital investment.

Overall, it is the wider construction industry that is being bullish about the future growth in the sector. CAB membership seem to be a little more cautious, possibly due to increasing costs and lack of materials at the present. Normally the membership is more bullish about future business, however, we could be seeing the start of significant construction boom, especially with infrastructure projects which will continue for some years to come.

www.c-a-b.org.uk