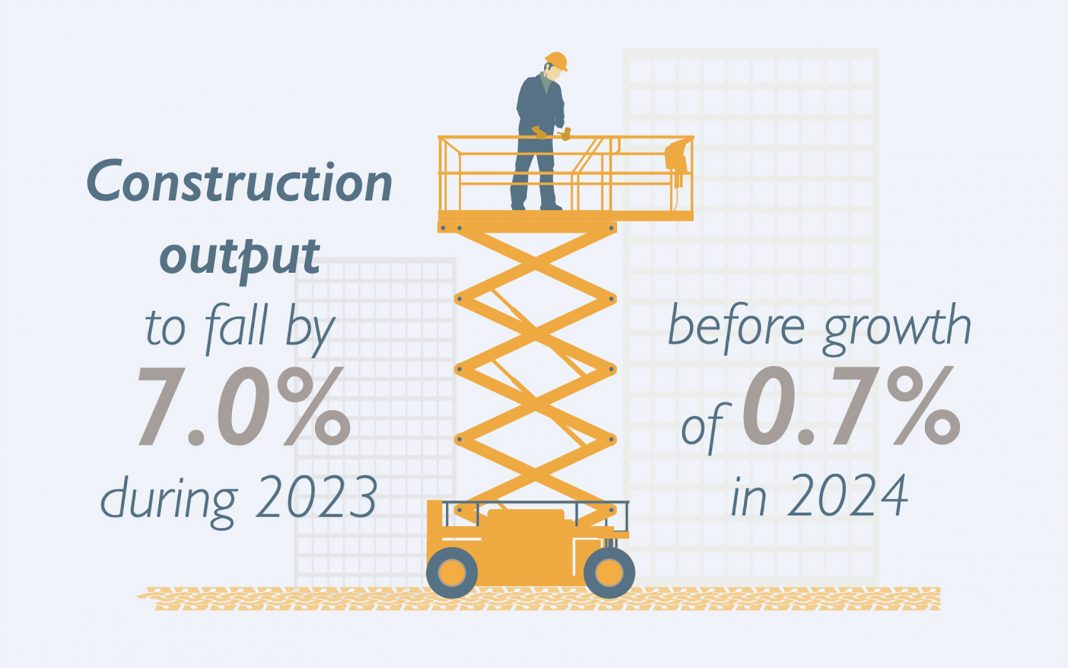

The construction industry is heading for an acute recession driven by double-digit falls both private house new build and retrofit, according to the latest forecasts from the Construction Products Association.

“With a flatlining UK economy, falling real wages, and mortgage rates now expected to continue rising over the next six months, households are likely to endure a difficult year and the demand for both new housing and improvements works will be hit hard,” says the association in its Summer Forecasts published this week.

Private housing is forecast to be the worst hit in 2023, in already forecast to fall in the wake of the government’s calamitous Mini Budget and the resultant spike in mortgage rates last year, which led to a 30-40% fall in demand in 2022 Q4.

“Whilst demand started to recover during the first quarter of this year as mortgage rates fell, this proved to be a mere blip and over the Summer, the Bank of England raised interest rates once again, in turn raising market expectations of peak interest rates beyond 6.0%. Given the impact of this on mortgage rates, demand will be badly affected in both the general housing market and house building sector.”

Overall, private housing starts are forecast to fall by 25.0% in 2023. Completions and output are expected to fall by 19.0% before a recovery starting in the second half of next year, which will see a rise of 2.0% in 2024 overall.

Private housing RMI, worth £29billion a year, has seen activity falling since March 2022 due to persistent inflation, rising interest and mortgage rates, and falling real wages. Households have been forced to pause or cancel small, discretionary improvements as a result. This was partially offset by growth in energy-efficiency activity, such as insulation and solar photovoltaic work, as homeowners with substantial savings prioritised investing in their homes following rising concern over energy prices since Russia’s invasion of Ukraine. The CPA forecasts: “This work is also likely to remain strong this year although government schemes for energy-efficiency retrofit of the existing housing stock such as ECO4 and ECO+ – now rebranded as the Great British Insulation Scheme – appear to be missing their targets once again.

“Larger home improvements activity remained strong last year but planning applications for new larger home improvements fell by 19.0% in 2022 as a result of homeowners being hit by rising mortgage payments and falling real wages. As a result, this is likely to lead to a fall in activity this year.”

Private home RMI is forecast to fall by 11.0% this year before growth of 2.0% next year in line with a recovery in household finances.

CPA Economics Director Professor Noble Francis said: “More than half of construction activity is provided by the three largest sectors: private housing new build, private housing repair, maintenance and improvement and infrastructure. Both housing new build and rm&i had already taken a hit in 2022 Q4 due to falling real wages, the rising cost of living, economic uncertainty, and the effect of the Government’s calamitous Mini Budget on mortgage rates.

“Further interest rate and mortgage rate rises this year, as well as falling real wages, are likely to lead to sharp falls in demand within the house building and improvements sectors. Exacerbating this for the construction industry are government announcements of delays to roads and rail projects, despite infrastructure activity remaining relatively high.

“The government’s previously stated ambitions – building 300,000 net additional homes per year, investing £600 billion in an infrastructure pipeline, delivering Levelling Up, and transitioning to Net Zero – all sound like hollow soundbites now given its lack of commitment and investment.

“He concluded: “It is essential that government uses its Autumn Statement later this year to invest in UK construction – an industry which employs more than three million people across its supply chain and provides the homes and infrastructure that are so vital for the country’s near-term needs and long-term productivity growth.”