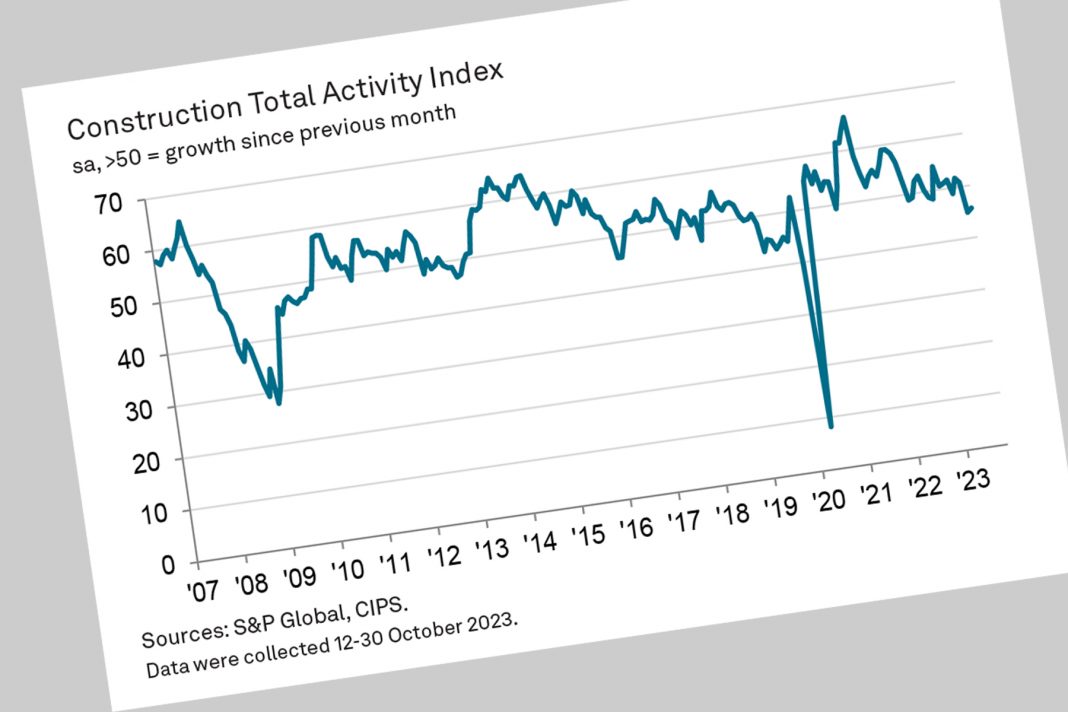

Housebuilding activity has now fallen for eleven months in succession, with a steep decline adding further to a gloomy outlook for Construction last month, according to the latest figures from S&P Global Market Intelligence.

Economics director Tim Moore said: “October data highlighted another solid reduction in UK construction output as elevated borrowing costs and a wait-and-see approach to new projects weighed on activity. House building decreased for the eleventh month running and once again saw a much steeper downturn than other parts of the construction sector. There were signs of stabilisation in the commercial building segment, however, with output falling only slightly since September.

“Total new work continued to fall more quickly than at any time since the initial pandemic lockdown period, which contributed to shrinking demand for construction products and materials during October. Competitive pressure on suppliers to pass on lower commodity prices resulted in the fastest decline in input costs since August 2009. Sub-contractors meanwhile cut their charges for the first time in more than three years in response to a further downturn in workloads during October.

” Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), said: “High interest rates and low consumer demand for new homes continue to drag down the UK construction sector, with a lack of new tender opportunities and a cutback of existing projects being reported across the house building industry.

“The silver lining is that high borrowing costs are having their intended effect of putting the brakes on rising inflation. Previously suppliers were able to hike their prices in response to soaring demand. Falling construction activity has now tilted the negotiations in favour of buyers and suppliers are having to pass on lower prices for raw materials like timber and steel. Supply chain pressures are also easing as a result of the lull in new work, with better availability of raw materials, a reduction in transportation costs and an improvement in supplier delivery times. More subcontractors are available for work and some are reducing their prices in reaction to the falling demand.

“However, there is no doubt that UK construction is in a difficult period and there will likely be further challenging months to come. Despite commercial building activity continuing to fall there were signs of stabilisation within this sub-segment, and this may provide a glimmer of hope which the wider construction sector will keep a close eye on as we move into next year.”