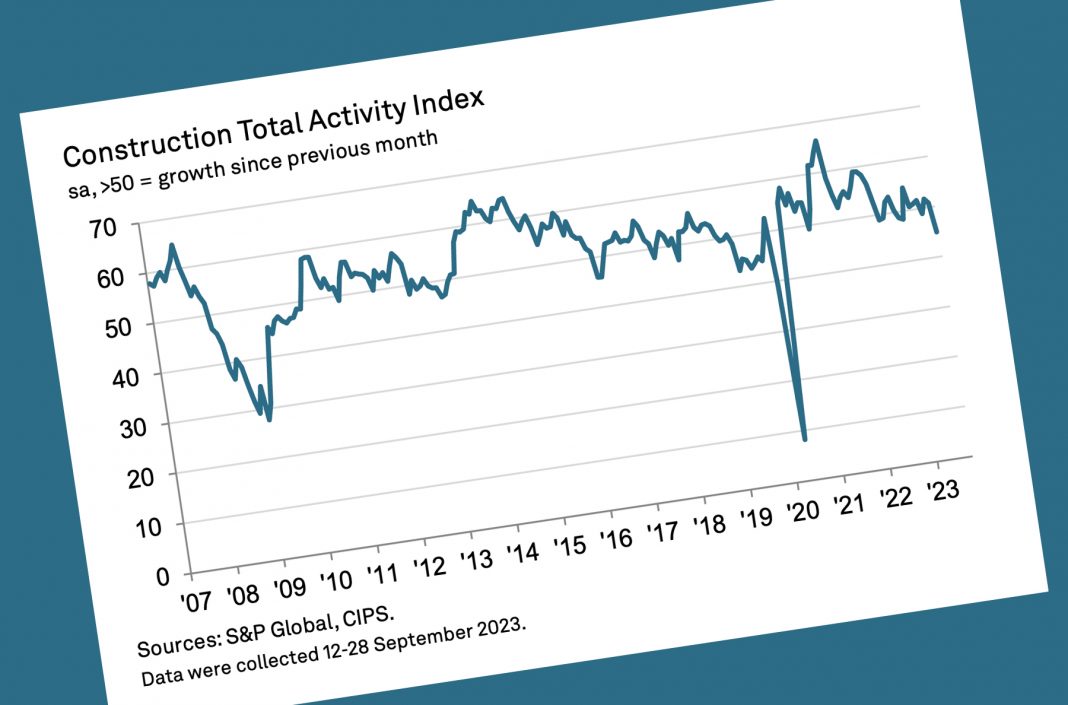

Construction activity fell at the fastest pace since May 2020 with housebuilding showing the steepest fall of all sectors.

At the same time, supplier performance continued to grow robustly and delivery times for products and materials shortened for the seventh month in succession.

Industry optimism grows ever more upbeat however with more than twice as many businesses forecasting a rise in output in the year ahead as companies forecast long-term expansion plans and grosing consumer confidence.

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “Output levels declined across the UK construction sector for the first time in three months during September and the latest downturn marked the worst overall performance since the early stages of the pandemic.

“A rapid decline in house building activity acted as a major drag on workloads, with construction companies widely commenting on cutbacks to new residential development projects in the wake of sluggish demand and rising borrowing costs. Concerns about the domestic economic outlook also dampened client spending during September, which contributed to the fastest reduction in commercial building since January 2021.

“The survey’s forward-looking measures once again remained relatively downbeat as order books decreased at an accelerated pace and business activity expectations eased to the lowest so far this year. Moreover, fewer project starts meant that sub-contractor availability increased to the greatest extent since the summer of 2009.

“Lower demand across the supply chain contributed to a robust improvement in delivery times for construction productions and materials, alongside a stabilisation in purchasing costs during September.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), said: “The impact of high mortgage rates and low house buying demand continues to flow through the supply chain and negatively hit the UK construction industry. It has been a tough year for residential construction and the sharp decline in September shows the pressure on the sector is still a long way from easing, despite the pause on the raising of interest rates.

“After some positive signs over the summer months, September saw a bump back down to earth for commercial construction as concerns over the future of the economy hampered demand and delayed new projects. “There is some comfort in the fact that the days of disrupted supply chains and soaring inflation are behind us for the time being, with delivery times continuing to fall and input prices remaining stable. The lack of activity has given space for suppliers to catch up with demand and create slack in the supply chain, which the construction sector will be hoping to take advantage of once demand returns.”