Materials supply problems throughout the industry showed the strongest improvement since 2009, according to the latest purchasing managers reports from S&P Global. At the same time however, house building showed the steepest decline for three years.

Continuing the theme of last month’s report, https://www.the-glazine.com/?p=9011 April saw improving materials availability, fewer transport delays and easing input price pressures combine to defeat recent supply woes, with the rate of cost inflation reaching the lowest for almost two-and-a-half years.

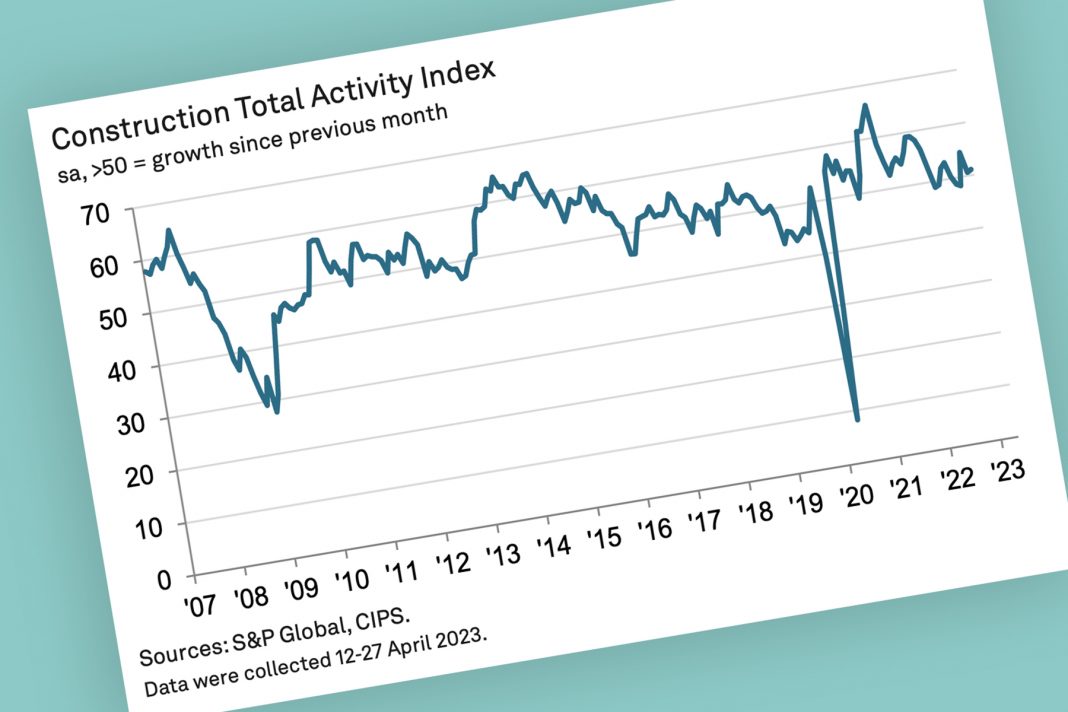

Tim Moore, economics director at S&P Global Market Intelligence, which compiles the survey, said: “The construction sector stretched out its current phase of expansion to three months in April, signalling a modest rebound from the downturn seen at the turn of the year. Commercial building work continued to outperform, helped by stabilising domestic economic conditions and a gradual rebound in business confidence. Civil engineering activity was also a driver of construction growth during April, with rising infrastructure work contributing to the best phase of expansion in this segment since the first half of 2022.

“However, the return to growth for UK construction output appears worryingly lopsided as residential work decreased for the fifth successive month. Extended delays on new housing starts were reported again in April, due to a considerable headwind from elevated mortgage rates and weak demand. While there have been some signs of a recent stabilisation in market conditions, this has yet to feed through to construction activity. In fact, the latest reduction in residential building was the fastest since May 2020.

“On a more positive note, the latest survey illustrated a further slowdown in input price inflation across the construction sector. Softer cost pressures partly reflected a sustained improvement in supply chain performance, with lead-times for deliveries of products and materials shortening to the greatest extent since September 2009.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), said: “The mixed picture found in the UK construction industry in April is representative of an economy still trying to recalibrate after being buffeted by the manifold challenges of political instability, lockdowns and supply chain pressures.

“The growth in the construction of commercial properties is welcome news, with the avoidance of a recession in the last quarter leading to clients being more willing to spend. The significant easing of supply chain disruption, with delays reduced and materials more readily available, also helped to alleviate cost pressures on the sector.

“However, the sharp decline in UK house building in April will be a cause for concern, as it becomes clear that the recent interest rate rises will continue to hamper consumer demand for some time to come. With a further rate rise expected next week there will be concerns that things will get worse before they get better for UK house builders.”