August saw a slump in housebuilding alongside the weakest activity forecasts since the beginning of the year and the fastest drop in new orders for over three years, according to the latest figures from S&P Global.

Better news came from suppliers’ delivery times for products and materials, which improved ‘at a robust pace’, stock availability also eased and an improved balance between demand and supply helped to stabilise overall input costs across the construction sector.

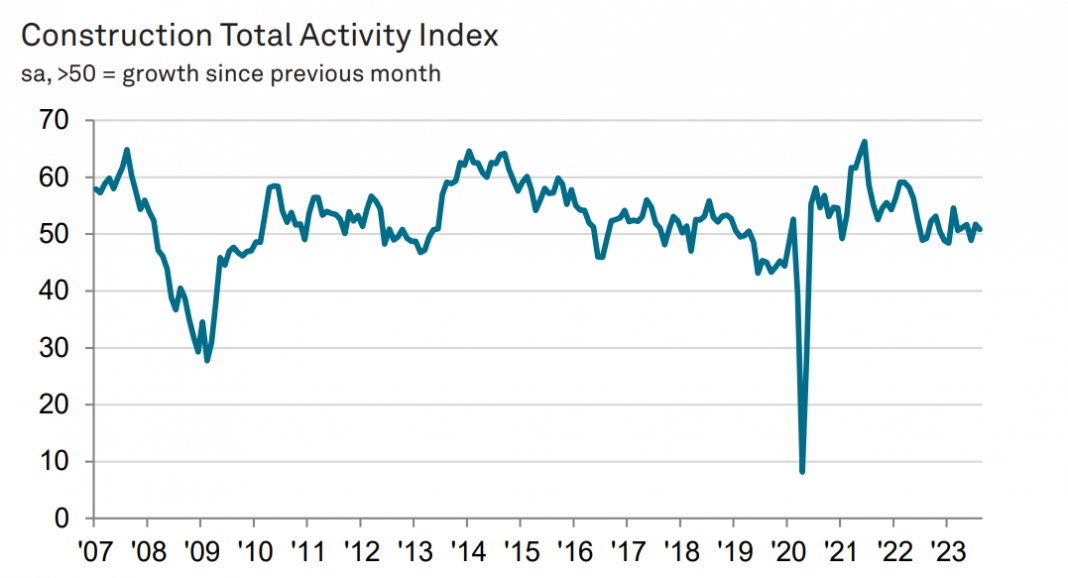

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said: “UK construction companies experienced another slump in house building activity during August as rising interest rates and subdued market conditions resulted in cutbacks to client demand and new build projects in particular. Aside from the pandemic, the recent downturn in residential work has been the steepest since spring 2009.

“Resilient demand for commercial work and infrastructure projects are helping to keep the construction sector in expansion mode for now, but the survey’s forward-looking indicators worsened in August. Total new orders decreased at the fastest pace for more than three years amid worries about the broader economic outlook and the impact of elevated borrowing costs. Rising risk aversion also meant that construction firms pared back their own output growth projections, with business activity expectations slipping to the weakest since January.

“August data pointed to a welcome stabilisation of costs across the construction sector and another sharp improvement in suppliers’ delivery times. Adding to signs of fewer capacity pressures, the latest survey revealed the sharpest rise in subcontractor availability for more than 13 years.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply (CIPS), said: “Though the construction sector overall showed an improvement in August, several imbalances in the figures give cause for concern.

“Residential building took another knock further into contraction as new housing starts weakened. The cost of living crisis continued to squeeze household finances and buyers were reluctant to commit in the shadow of potentially another interest rate in September. Housing activity fell at its second sharpest level since 2009, excluding the pandemic years, and overall new orders dropped at the fastest rate since May 2020. The sector was propped up overall by some improvements in commercial activity such as office refurbishments.

“This below par performance had a knock-on effect on job creation which was starting to lose momentum. The right skills remained in short supply and without pipelines of new work coming through, recruitment levels were reduced.

“One bright spot in August’s figures was the second biggest improvement in supplier delivery times for 14 years as constraints on raw materials eased and supply chain performance improved.”