All Clear for Growth in the Domestic Glazing Market

30th September 2014

|

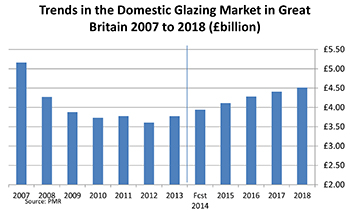

Growing consumer confidence, a burgeoning housing market and a low interest rate environment helped boost the domestic glazing market in Great Britain in 2013. And growth looks set to continue through to 2018. “We’re entering the longest period of prolonged growth for this market since the nineties” says Robert Palmer, director of Palmer Market Research.

After continuing to decline in the first quarter of 2013, the market dramatically switched to growth in the second quarter, ending up for the year nearly 5% higher at £3.78 billion. By sector, the market in new build housing shot up 17% and in home improvements by a more modest 4%. Only social housing refurbishment failed to see an increase, down just over 2%.

Government initiatives, in particular the Help to Buy scheme, have had an important effect on new build and will continue to do so through to 2018 and even beyond. Rising interest rates will be something of a dampener but even so by 2018 the market is forecast to be 50% bigger than it was in 2013.

The strengthening housing market itself is also helping home improvements as homeowners feel that these are now worth making again. The higher number of housing transactions boosted the replacement market which saw growth for the first time in ten years. Overall the home improvement market will grow by nearly a fifth between 2013 and 2018.

More negatively, funding issues after the winding down of the Decent Homes Programme will mean little or no growth in social housing refurbishment over the period to 2018.

But 2013 saw other important trends. Aluminium started to make a comeback with its share growing from 5% to 8%. Disappointingly, bifold doors failed to maintain the growth it saw in previous years; rather than increasing, the market actually fell by 7%. Although Palmer’s forecast has been downgraded since last year, the market for bifolds is still seen as growing in the long term not least because they are an aspirational part of the growing trend to brick built extensions.

In the window market, vertical sliding sash and tilt & turn styles saw growth of a fifth in 2013, while in the entrance door market composites increased their dominance to reach 40% share.

The conservatory market continues to disappoint with a 2% fall in 2013. But that masks a near 40% growth in replacements and a 10% decline in first time installations.

Triple glazing is still in its infancy in this market. In 2013 incidence in windows was between 1½ and 2½% according to sector, but more than double that in entrance doors. “Triple glazing is bound to grow strongly in the coming years as it becomes an irresistible marketing challenge for suppliers” says Palmer.

The Window, Door and Conservatory Markets in Housing in Great Britain, 2014 edition, was developed by carrying out structured interviews with 674 companies operating in the market, including housebuilders, manufacturers, and housing associations, between April and June 2014.

As ever, this was backed up by an extensive desk research programme, as well as Palmer Market Research’s proprietary database which stretches back for over 30 years.

For full details visit the website: www.palmermarketresearch.co.uk

|